Kenya has secured a Ksh22 billion Samurai loan facility from Japan to strengthen industrial growth and cut electricity costs.

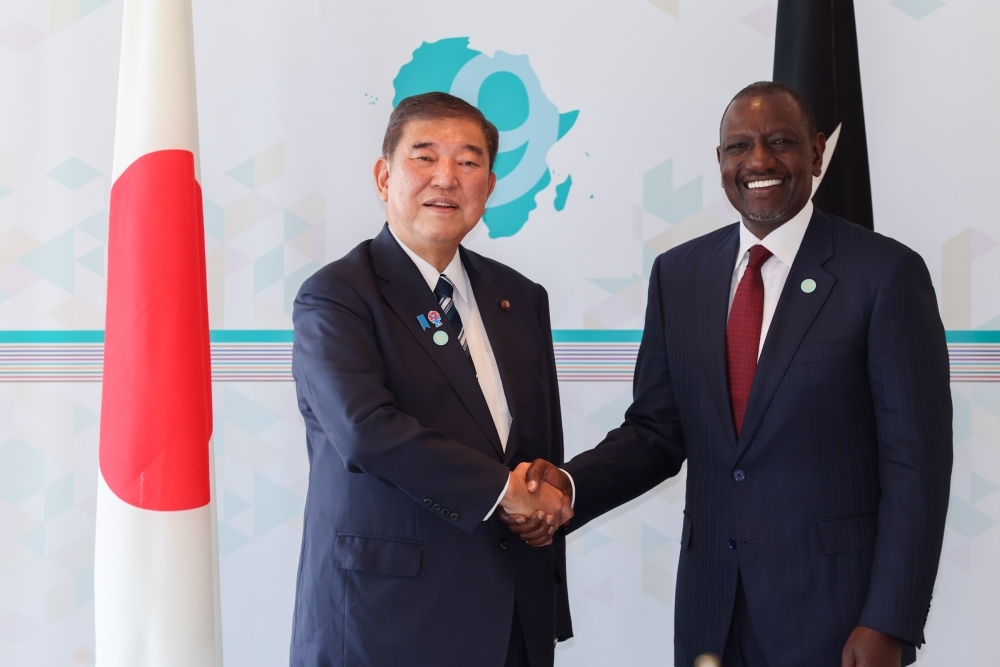

The financing deal was signed on the sidelines of the Ninth Tokyo International Conference on African Development (TICAD 9) in Yokohama, witnessed by President William Ruto and Japanese Prime Minister Shigeru Ishiba. Prime Cabinet Secretary Musalia Mudavadi signed on behalf of Kenya, while Nippon Export and Investment Insurance (NEXI) CEO Atsuo Kuroda represented Japan.

“This unique Samurai financing facility will promote our transformative program to stimulate the entire automotive value chain, foster linkages with other sectors, and promote innovation, research and development,” said Mudavadi.

The facility will channel Ksh13.1 billion to the Ministry of Investment, Trade and Industry to support local vehicle assemblers, scale up electric vehicle production, and train youth for green automotive jobs. Another Sh4.8 billion will go to the Ministry of Energy for high-efficiency transformers to cut system losses and reduce power bills, while Ksh3.9 billion will support general government expenditure.

Mudavadi emphasized that the facility demonstrates Kenya’s shift towards diversified, non-traditional borrowing while advancing the Bottom-Up Economic Transformation Agenda (BETA).

President Ruto used the TICAD platform to criticize international credit rating agencies, saying Africa suffers from unfair assessments that inflate borrowing costs. He renewed calls for an Africa Credit Rating Agency, arguing such reforms are vital to unlock affordable and sustainable development financing.

Ruto also urged African leaders to expand intra-continental trade, citing UNCTAD data showing that only 18 per cent of Africa’s exports are traded within the continent, compared to over 60 per cent in Europe and Asia.

The Samurai loan has a seven-year repayment period, with Kenya’s National Treasury set to formalize credit access with NEXI.

paypal casinos for usa players

References:

https://www.madeinna.org

online casino that accepts paypal

References:

https://chefstaffingsolutions.com/

The hotel’s suites, as well as the rooms in the Spa Tower, were renovated in 2007.

It was the most popular high-limit poker room in Las Vegas,

until the nearby Aria resort opened in 2009. The casino includes a high-limit poker area, originally

known as Bobby’s Room. By 2004, Bellagio was the most profitable hotel-casino in Las Vegas.

The expansion would also include an additional spa,

salon, meeting and retail space, as well as a new restaurant.

The new Spa Tower would be built south of the main tower and would offer access

to the spa.

Las Vegas developer Irwin Molasky said, “In our lifetime we will never see another building or hotel with such beauty and grace”.

Casino executive Bobby Baldwin served as the resort’s president.

More than half of the resort’s revenue was expected to come from

non-gaming amenities. Other attractions included a conservatory and the $285 million Bellagio Gallery of Fine

Art. The resort’s main attraction was an 8.5-acre man-made lake, featuring a water show

known as Fountains of Bellagio.

52-story hotel with panoramic views of city skyline – Located between Bellagio

and CityCenter. On the Las Vegas strip – 3 MI, 10 min from Harry Reid Intl airport.

The Howard W. Cannon Aviation Museum, located at McCarran International Airport in Las Vegas, Nevada, is a must-visit for aviation enthusiasts and history buffs.

The Nevada State Museum, located in Carson City, Nevada,

is a treasure trove of the state’s rich history, culture, and natural wonders.

Nestled in the heart of Pahrump, Nevada, the Pahrump Valley Museum offers a captivating glimpse

into the area’s rich history and heritage.

References:

https://blackcoin.co/razed-casino-a-fresh-spin-on-online-gaming-in-australia/

We list the best online casino payouts, so you can play confidently, knowing

you’re maximizing your chances of bigger returns. Our expert gamblers also give advice on the best casino games to play and share tips and

strategies to help you do well at the casino tables. This includes information about the site’s safety, the variety of games, software providers, and available bonuses.

In Australia you can even find some no deposit bonus casinos.

Ricky Casino accepts 10+ deposit methods, so it’s safe to say their banking menu

covers all the bases. Games like Sic-Bo, Pai Gow Poker,

Jogo do Bicho, 88 Bingo 88, and Super Keno fill in the edges for players who’d

like to broaden their horizons. Ricky Casino was our #1 pick overall, but we’ve

got more casinos ready to compete for the

throne. If you think you have a gambling problem, reach out to When you read the

bonus description, you will see that the deposit cash bonus and the free spins must be wagered 30x, 40x, or more

times.

References:

https://blackcoin.co/razz-fourth-street-play-an-easy-guide-on-how-to-keep-your-money-safe-and-double-your-wins/

Leider kein passendes Angebot gefunden Sie benötigen ein Konto, um

diesen Artikel zu Ihrem Wunschzettel hinzuzufügen, bitte

melden Sie sich an oder registrieren Sie sich Wenn Sie sich noch nicht registriert haben, nutzen Sie die Gelegenheit und melden Sie sich an. Denn bei dem

wahren Geist der Weihnacht geht es darum, Erinnerungen zu schaffen, die über die Jahre anhalten. Die besten Geschenke werden nicht in Papier eingewickelt, sondern bestehen aus neuen Erlebnissen.Schenken Sie Ihren Liebsten Zeit in einer Atmosphäre

voller Magie und Komfort.

In Traumlage auf einem Felsen mit toller Aussicht auf Funchal und den Hafen. Hallo, bitte wende dich hierzu

gern an unsere Reiseberater. Wir möchten gerne ein ruhiges Zimmer in den oberen Etagen, und ist ein Wasserkocher auf dem

Zimmer ?? Darf ich auf dem Balkon rauchen?

Der internationale Flughafen von Madeira befindet

sich nur 20 km entfernt. Im Tal Curral das Freiras zeigt sich das

Landesinnere von Madeira mit seinen atemberaubenden Ausblicken auf die umliegenden Wälder von seiner

schönsten Seite.Dieses Hotel befindet sich nur fünf Minuten zu

Fuß vom Zentrum Funchals entfernt. Lassen Sie sich in den vier Restaurants und Bars mit Panoramablick verwöhnen, spielen Sie eine Partie auf dem Tennisplatz oder

nutzen Sie den direkten Zugang zum Casino da Madeira, inklusive Spielzimmer,

Shows und Diskothek. Es befindet sich direkt am Kreuzfahrthafen in der Bucht

von Funchal, nur fünf Minuten zu Fuß vom Stadtzentrum und dem Mittelpunkt des gesellschaftlichen und kulturellen Lebens entfernt.Mit seiner Lage direkt am Meer ist das Hotel

eines der beliebtesten der Insel Madeira. Der Spa des gegenüberliegenden Schwesterhotel Pestana Casino

Ocean and Spa Hotel kann mitbenutzt werden. Zu diesem Anlass,

der die Insel weit über ihre Grenzen hinaus bekannt gemacht hat,

sind die Straßen in ein buntes, duftendes Blumenmeer gehüllt.

References:

https://online-spielhallen.de/stakes-casino-promo-code-ihr-guide-zu-boni-und-vorteilen/

Thank you for every other informative blog. Where else culd I get that kind oof information written iin such

a perfect means? I have a mission that I’m jusst now operating on, and I’ve been on the look ouut forr such

info. https://Hallofgodsinglassi.wordpress.com/

Your advice is exactly what I needed right now.