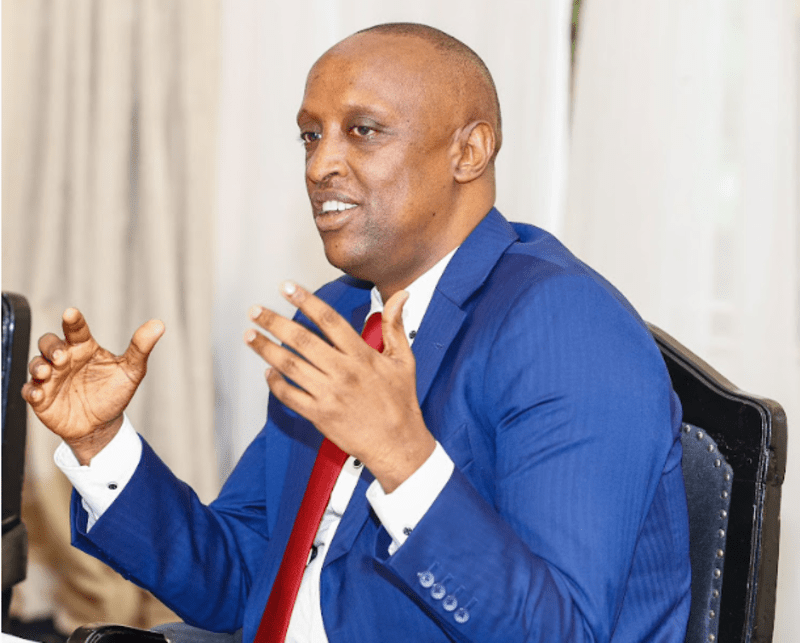

Kiharu MP Ndindi Nyoro has sold part of his long-running investment in Kenya Power, offloading 3.08 million shares valued at Ksh 37.8 million in the six months to June 2025. The move slightly reduced his holdings but did not shake his position as the electricity distributor’s top individual investor.

Nyoro’s stake now stands at 26.9 million shares, down from 30 million in December 2024. At Kenya Power’s closing price of Ksh 12 as of December 4, 2025, the MP’s remaining shares are valued at approximately Ksh 322.8 million a major jump from previous years driven by the company’s return to profitability and improved dividend payouts.

The legislator first bought his shares when the stock traded at much lower levels, steadily increasing his portfolio over the years. Kenya Power’s share price has since surged nearly eight-fold, peaking at Ksh 15.8 in October 2025, boosting long-term investors who bought in during the utility’s troubled years.

Other individual investors have also grown their positions this year. James Ochieng Ooko added 1.39 million shares to reach 13.67 million units, while Nehemia Ikuah purchased an additional 1.29 million shares, bringing his total to 11.27 million.

Kenya Power reported a profit of Ksh 24.47 billion in the 2024/2025 financial year, supported by total revenues of Ksh 219.29 billion. The board recommended a final dividend of Ksh 0.80 per share, on top of an earlier interim payout of Ksh 0.20, marking the second year of renewed shareholder rewards. Board chairperson Joy Brenda Masinde said the improved performance reflects the utility’s ongoing recovery and transformation plan.

best online casino usa paypal

References:

vk1bj3qdukp4i.com

online casino with paypal

References:

taradmai.com

Activate the Search button to allow the AI to

browse the internet for real-time data and events for its answers.

Chat bots can proactively initiate conversations with customers,

making them a powerful tool for marketing. It employs Natural Language Processing (NLP) to interpret text and identify intent, while machine learning

allows it to improve its responses over time

based on past interactions.

You probably didn’t publish your changes in the chatbot.

One chatbot can be connected to multiple channels, such

as any website or online store, Shopify, LiveChat, Slack, and Facebook

Messenger. Once qualified, these leads can be seamlessly transferred to sales

representatives in real-time, ensuring that no opportunity is missed.

These AI-powered customer service bots can understand

complex queries, provide accurate answers, and learn from

previous interactions.

Check our website for special offers and discounts on your favourite movies.

Stay updated with the latest movie ticket prices for upcoming releases.

Follow the easy checkout process, and your tickets will be

ready for you at the cinema. Secure your

seats from the comfort of your home and enjoy a seamless movie-going

experience. Planning a movie night?

References:

https://blackcoin.co/59_online-casino-vip-programs_rewrite_1/

What are some alternative words for ‘key’ and ‘important’?

In this section, we will explore both absolute and near synonyms for “important.” “Important”

conveys a sense of value or significance, while “essential” indicates something that is absolutely necessary.

Why are synonyms important? Common stronger choices are essential, critical,

crucial, and vital. First think about why the thing matters.

Some words match important closely, while others are

near synonyms that add extra meaning. Important synonyms fall into types

based on why something matters. Using synonyms is a great way of enhancing your writing.

Some show need, some show impact, and some show urgency, so one word

may not fit every sentence. If it matters because many people

respect it, choose notable or influential. If it matters because it comes first,

pick key, main, or primary. If it matters because you need it, choose essential, necessary,

or vital.

References:

https://blackcoin.co/59_online-casino-vip-programs_rewrite_1/

Ich werde Ihre Beschwerde nun an meinen Kollegen Peter weiterleiten ( [email protected] ), die Ihnen gerne behilflich sein werden. Wir verwenden auf

unseren Seiten Affiliate-Links und erhalten möglicherweise eine Provision für

Kunden, die an Online Casinos verwiesen werden. Teilen Sie Ihre Meinung mit oder erhalten Sie Antworten auf Ihre Fragen. Sie war verwirrt

und verärgert und bat um Unterstützung, um ihre Gewinne zurückzuerhalten.

Bestandskunden erhalten regelmäßig Reload-Boni und Cashback-Angebote.

Standardmäßig konzentriert sich die Plattform auf Einzahlungsboni.

Die mobile Version bietet dieselben Spiele und Features wie die Desktop-Version. X7 Casino online unterstützt etablierte und moderne Zahlungsmethoden. X7 Casino online partnert

mit Evolution Gaming und Pragmatic Play Live für authentische Dealer-Erlebnisse.

Beispiele sind “Bonanza Megaways” und “Extra Chilli”.

Das vom Unternehmen Starscream Limited mit einer Kahnawake-Lizenz betriebene

X7 Casino bietet bei Anmeldung über unseren Link ein exklusives Willkommenspaket.

Das X7 Casino veranstaltet regelmäßig spannende Turniere und bietet attraktive Promotionen. Mit über 5.200 Spielen bietet das X7

Casino eine der umfangreichsten Bibliotheken auf dem

Markt. Das X7 Casino bietet eine breite Palette an Optionen und spricht damit sowohl traditionelle als auch moderne Spieler an.

References:

https://online-spielhallen.de/verde-casino-promo-code-2025-alle-bonusangebote/