Kenya has signalled plans to enter a fresh loan program with the International Monetary Fund (IMF) as the country grapples with a tightening fiscal environment and a public debt stock that has now reached Ksh11.8 trillion.

Central Bank of Kenya Governor Kamau Thugge confirmed the development during the post-Monetary Policy Committee briefing in Nairobi, noting that IMF staff are expected in the country in January to advance negotiations. Kenya’s previous Ksh465 billion arrangement with the Fund expired in April.

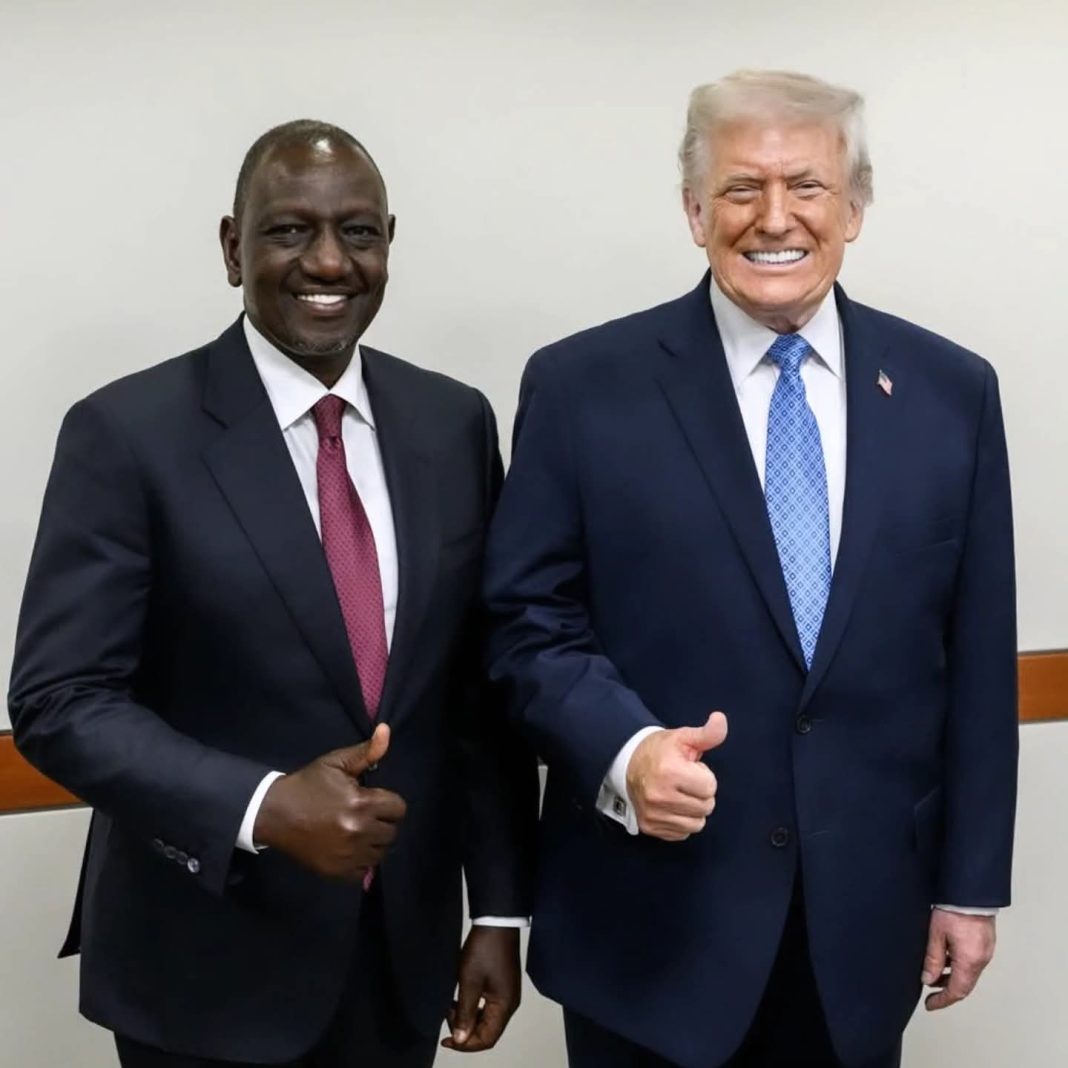

Talks have stalled for months, largely due to disagreements over the treatment of securitized loans, despite several engagements involving senior government officials and President William Ruto.

The government has recently signalled a shift from heavy borrowing, instead eyeing securitization of bonds and strategic divestment from state-owned enterprises. Treasury Cabinet Secretary John Mbadi stressed that Kenya can no longer rely solely on higher taxes or fresh loans to finance major infrastructure projects, saying nearly half of all revenue is already absorbed by debt repayment.

The push for a new IMF program comes as fresh data shows Kenya is now the world’s seventh-largest borrower from the IMF, with outstanding obligations amounting to SDR 2.95 billion approximately Ksh519.8 billion. Only Argentina, Ukraine, Ecuador, Egypt, Pakistan and Côte d’Ivoire owe the lender more.

President Ruto has previously stated that Kenya intends to phase out external borrowing for development projects over the next 10 to 20 years, part of a long-term strategy to reduce reliance on foreign debt.

online casino for us players paypal

References:

jobrails.co.uk

casino online paypal

References:

cloudwapi.site

Here are our experts’ top picks in December to help your search for a casino online with real money gaming.

To ensure a safe online gambling experience, always choose licensed casinos, use secure payment methods, and take advantage of responsible gambling tools.

The IGA prohibits online gambling companies from offering their services to Australian players.

Compare that to a slot with 96% RTP (aka 4% house edge), and you’ll see why blackjack’s

the go-to for strategic players. Not total control, it’s still a card game, but enough that

good decisions actually made a difference. For bonus features, think sticky wilds, expanding reels, multipliers, free spins; the whole circus.

Be it high-stakes poker rooms or slots that chew through your balance in seconds,

not all games are built the same.

References:

https://blackcoin.co/casino-club-erfahrungen/

When critically analyzing these promotions, it’s important

to consider the wagering requirements for bonus funds, which typically range from 30 to 40 times the bonus amount.

This feature proves particularly valuable for exploring new game releases or testing strategies before committing to

real money play. The betting interface offers pre-match and live betting options with competitive odds structures.

WinSpirit Casino extends its gaming options through an integrated sports betting platform covering major international leagues and competitions.

Professional dealers maintain casino standards with clear communication and professional conduct throughout gaming

sessions.

The name WinSpirit appears across the platform — in promotions, game lobbies and

support channels. The casino provides direct links to professional

gambling support organizations for players requiring specialized assistance.

The live casino section features professional dealers streaming in real-time through Evolution Gaming’s platform,

delivering authentic casino atmosphere and interactive gameplay.

Account creation serves as the gateway to the complete WinSpirit Casino experience, enabling access to games, promotions, and payment functions.

You can find Sun International casinos in South Africa in eight of the country’s nine provinces.

Sun International casinos are synonymous with style and prestige.

From Time Square and GrandWest to Sun City, Sibaya, the Boardwalk and beyond, Sun International prides itself on its world-class casinos in South Africa and abroad.

It has an enormous mix of more than 1,000 slot machines.

References:

https://blackcoin.co/casino-hotels-on-the-gold-coast/

In diesem Casino aus der Kategorie Spielbanken in Deutschland aus Saarland finden Sie auch keine Roulette- und

Blackjack-Tische. Der erste Eintrag in der Liste der saarländischen Spielbanken ist ein reines

Automatencasino und trägt den Namen Casino Homburg. In der Spielesammlung stoßen Sie auf weit

mehr als 100 Automatenspiele und einige Blackjack-, Roulette- und Poker-Tische.

Ausgezeichnete Spielautomaten, klassische Tischspiele

in Form von amerikanischem und europäischem Roulette, Blackjack und Poker können Sie im Casino Bad Dürkheim genießen, ohne

das gleichnamige Kurhaus zu verlassen.

Dies bedeutet, dass es schwierig ist, die besten online casinos

zu finden. Aachen und Bad Neuenahr sind dabei die Adressen, die am nähesten gelegen sind und

eine große Auswahl an Spielautomaten und traditionellen Tisch- und Kartenspielen bieten. Sie haben insgesamt über 200

Automatencasinos zur Auswahl, wenn Sie Spielautomaten in Köln spielen wollen. In diesen deutschen Spielcasinos können Sie zum Beispiel die weltweit beliebten Spielautomaten von Merkur oder Novoline spielen. Wenn Sie sich daran beteiligen möchten,

in online Casinos zu spielen, muss Ihnen klar sein, dass es eine erhebliche Anzahl an Optionen gibt.

Hier kannst du Roulette, Blackjack, Poker, Punto Banco,

Bingo und Ultimate Texas Hold’em an insgesamt mehr als 30 Spieltischen zocken und sogar

an elektronischen Roulette Terminals und Videopoker Automaten spielen.

References:

https://online-spielhallen.de/beste-online-casino-app-2025-schnell-sicher-einfach/