The Kiambu County Assembly has passed the Valuation and Rating Bill, 2024. The bill introduces significant reforms to land taxation, including the elimination of land tax on freehold and commercial agricultural land and a reduction in penalties for late payment of land rates.

The passage of the bill follows a memorandum from Governor Kimani Wamatangi, who recommended exempting all freehold land not exceeding 10 acres from taxation. This move provides substantial relief to landowners who have been burdened by the previous tax regime.

One of the most significant changes in the bill is the reduction in penalties for late payment of land rates from 36% per annum to 10% per annum. This makes it easier for landowners to comply with payment schedules and reduces the financial strain on commercial landowners.

Additionally, the bill curbs the county government’s power to auction land for unpaid rates. Previously, the law allowed for the auctioning of land if the owner failed to pay land rates. The new bill provides greater security to landowners by limiting this punitive measure.

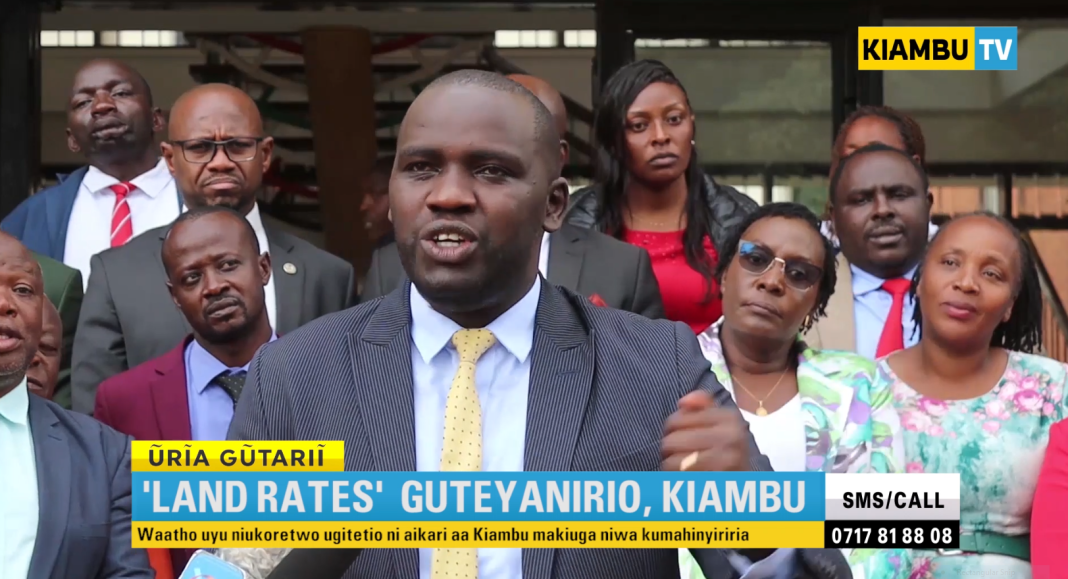

The amendments to the bill were driven by public petitions and the efforts of local leaders who listened to the concerns of their constituents. Karuri MCA Peter Wainana, who moved the amendments, emphasized that the changes were made in response to the cries of Kiambu residents who found the previous law punitive.

The passage of the Valuation and Rating Bill, 2024, is seen as a significant step towards fairer land taxation and reduced penalties for commercial landowners. This move is expected to foster a more supportive environment for landowners and contribute to the overall economic well-being of Kiambu County.

[2856]Boss778 Philippines: Top Slot Games, Secure Login, & Easy Register. Download the App and Access Link Alternatif for the Best Online Casino Experience. Experience the ultimate online casino at Boss778 Philippines. Enjoy top boss778 slot games, secure boss778 login, and easy boss778 register. Access the boss778 download app and link alternatif now! visit: boss778

paypal online casinos

References:

lr-mediconsult.de

online casino for us players paypal

References:

wedeohire.com

You can browse through the large game selections at top-rated online

casinos in America and find a seemingly endless selection of other games to play.

Bonuses at online casinos increase your account balance, allowing you to play more games, claim cashbacks, loyalty

rewards, and more. Most real-money online casinos offer a

range of payment options, including credit/debit cards, e-wallets like

PayPal and Skrill, prepaid cards, and direct bank transfers.

Top USA online casinos implement these features to ensure

players can enjoy online casino gambling responsibly and safely gamble online.

Real money online casinos and sweepstakes casinos provide unique gaming experiences, each having its own advantages and drawbacks.

By featuring games from a variety of software providers, online

casinos ensure a rich and varied gaming library, catering to different tastes

and preferences.

The top mobile casinos let you experience enhanced gameplay,

easy account management, and extensive customer support from

your mobile device. In our experience, they also have exclusive

bonuses that are much more generous than standard

casinos accepting debit card or e-wallet payments. What’s more,

it also offers players a casino and sportsbook, making it an all-round gambling site.

Players won’t just find poker though – they’ll also

find loads of casino games and some great bonuses.

There are a few ways to play blackjack, but the challenge of getting as close as possible to 21, and beating the dealer into the bargain, remains

the objective. You can also investigate the various

regular promotions and the Rush Rewards loyalty scheme,

which is a points-based tier system offering more rewards and perks.

You can also play on the go with the bet365 Casino mobile app, which is a great approximation of the desktop site and allows for easy access to other bet365 products.

You can also get 100% of your first deposit matched up to a

maximum amount of $1,000. Welcome to the most extensive

list of the Best Real Money Online Casinos available to play today!

With expert strategy guides, news, and insights, the platform continues to evolve alongside the game and

its community.

Live DJ every Saturday & Sunday from 2pm – 7pm Gaming positions require successful

applicants to obtain a casino operatives licence, which stipulates

a clear criminal history. Employees enjoy free meals while on shift, fully-laundered uniforms where required, and free parking.

At Mindil Beach Casino Resort, we operate as a

team and strive to provide an outstanding experience for our guests and

employees alike. Every Wednesday & Thursday dinner only

Best enjoyed with friends, our banquet menu options are an easy crowd-pleaser featuring

a wide variety of our most popular dishes. Join us on the lawns on Saturday, 26th April 2025 from 5pm for fun,

food and entertainment in true territory style. But

there’s still a chance to join the celebration — limited table bookings are

still available at Sandbar and il Piatto, offering prime positioning

and a premium experience. All Gaming & Major Promotions are R18 & exclusive to Lucky North Club Members.

This Dry Season, experience the enchantment and

energy of Carnivale brought to life in a way only Mindil Beach Casino Resort can deliver.

From 19 July, earn entries and join us every hour from 6pm on Saturdays

& 3pm on Sundays for your shot at another game show-style excitement!

Inspired by global spa culture and the natural beauty of the landscape and ocean environment surrounding us,

we are proud to offer you a bespoke collection of sublime iKOU Spa Rituals.

The Vue Bar is open dailySunday to Thursday 10am – 10pmFriday

& Saturday 10am – 1am The Vue offers an inviting, open-plan space perfect for

everything from casual coffees to indulgent dinners.

Our experienced team can assist with planning and execution, plus

catering and accommodation. The impressive Beachside

Pavilion overlooks the Arafura sea and is Darwin’s only five-star

beachside function venue.

References:

https://blackcoin.co/vip-online-casinos-2023-online-casinos-for-vip-players/

Regelmäßig veröffentlichte Codes für Twists & Freispiele Gametwist ist nicht für

Spieler gedacht, die auf Echtgeldgewinne hoffen. Wer einfach entspannt zocken möchte, findet bei Gametwist online genau das.

Wahre Asse des Mumien-Spektakels Book of Ra online finden auf GameTwist übrigens die ideale Gelegenheit, um ihr Können zu zeigen!

Ein Tausch gegen Echtgeld ist nicht möglich und ihr könnt bei

Gametwist grundsätzlich kein Echtgeld setzen. Gespielt wird mit den virtuellen Währungen Twist

oder oder Skill-Coins. Alle Spiele werden mit einer virtuellen Währung

gespielt, die ihr zuvor käuflich erwerben müsst. GameTwist ist eine

Unterhaltungsplattform, bei der sich alles um

euer Spielvergnügen dreht. Gespielt wird mit einer virtuellen Währung, den Twists, die ihr kaufen müsst oder

als Bonus-Guthaben erhaltet.

Oder wolltest du schon immer mal in die Vergangenheit reisen und legendäre Abenteuer-Games spielen? Alle GameTwist-Slotmaschinen machen deinen PC,

dein Smartphone oder dein Tablet zum virtuellen Casino, das es ermöglicht,

ganz ohne technische Hürden zu spielen. Echte Abenteurer zeigen keine Furcht und gehen aufs Ganze – auch wenn sie den Classic von Novoline kostenlos spielen! So lässt sich lange

spielen, ohne ständig neu nachkaufen zu müssen, wenn mal eine Pechsträhne auftritt.

Der tierische Vierbeiner-Slot legt mit einem Walzenfeld im 6-mal-6-Format, Cluster-pays ab 5 gleichen Symbolen,

einem Barkin‘ Re-Spin nach jedem Treffer und bis zu 40 möglichen Freispielen ganz

viele saftige Knochen vor die Hundehütte. Halte Ausschau nach den Bronze-, Silver- oder

Gold-Trophy-Spins, die dir mit speziellen Freispielen und fixierten Wild-Symbolen die besten Karten auf die Hand geben.

References:

https://online-spielhallen.de/mr-bet-casino-erfahrungen-ein-umfassender-blick-auf-meine-spieljahre/

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/vi/register?ref=MFN0EVO1

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Their global health insights are enlightening.

can i order generic cytotec prices

The team always keeps patient safety at the forefront.

The most pleasant pharmacy experience every time.

buy generic cytotec without dr prescription

Speedy service with a smile!

Their loyalty program offers great deals.

gabapentin and elevated blood sugar

They have an extensive range of skincare products.

Stellar service in every department.

buying generic cytotec without insurance

Their commitment to global patient welfare is commendable.

They provide a global perspective on local health issues.

lisinopril medication used for diabetes

Their commitment to international standards is evident.

Their vaccination services are quick and easy.

can you get lisinopril pills

Medscape Drugs & Diseases.