The government has unveiled sweeping reforms at the Kenya Tea Development Agency (KTDA) aimed at protecting smallholder farmers from financial exploitation and restoring confidence in the tea sector.

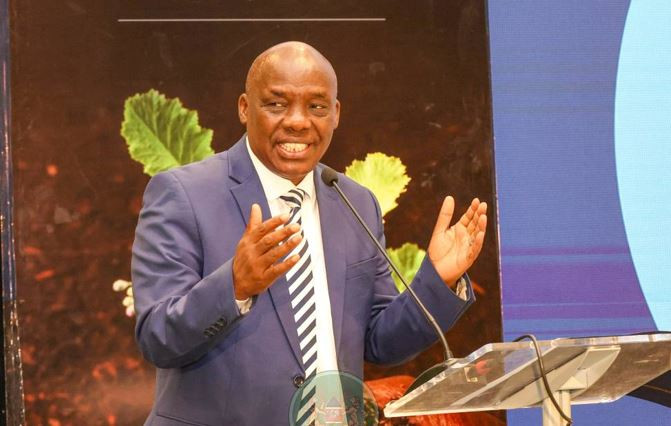

Agriculture Principal Secretary Paul Ronoh announced that tea farmers’ funds will no longer be used as collateral for bank loans, saying the move is meant to shield growers from unnecessary financial risk and curb abuse by factory management. The ban forms part of a broader restructuring programme targeting transparency and accountability across KTDA operations.

As part of the reforms, KTDA has been directed to close multiple factory bank accounts and operate under a streamlined financial system to allow clearer tracking of income, expenditure and foreign exchange earnings. Ronoh said each factory will retain visibility over its own revenues while ensuring tighter oversight on operational costs.

The government has also launched lifestyle and forensic audits targeting both current and former tea factory directors following allegations of mismanagement and misuse of farmers’ money. Authorities say the audits will help recover lost funds and hold those responsible to account.

Additionally, the long-standing inter-factory loan system is being phased out, with KTDA shifting towards commercial bank financing. The move follows revelations that factories in the West Rift borrowed billions of shillings from their East Rift counterparts, with much of the money remaining unpaid.

Officials say the reforms are designed to safeguard the interests of over 680,000 smallholder tea farmers, stabilise bonus payments, and strengthen governance in one of Kenya’s most important agricultural sectors.

Some really nice stuff on this internet site, I enjoy it.

8l5v31

There are some attention-grabbing time limits in this article however I don’t know if I see all of them middle to heart. There may be some validity but I will take hold opinion till I look into it further. Good article , thanks and we want extra! Added to FeedBurner as nicely

I am really enjoying the theme/design of your blog. Do you ever run into any web browser compatibility problems? A couple of my blog audience have complained about my blog not operating correctly in Explorer but looks great in Firefox. Do you have any suggestions to help fix this problem?

Hi, i think that i saw you visited my weblog so i came to “return the favor”.I am attempting to find things to improve my web site!I suppose its ok to use some of your ideas!!